How ISO Payments Can Help You Grow Your Business

With ISO payments solutions, you can get the right point-of-sale setup and credit card processing for your business. Learn about the other benefits.

Or give us a call at (737) 256 7458

See how other business owners feel about working with us.

Cover your invoice upfront and spread your costs over installments allowing you to use working capital on growing your business.

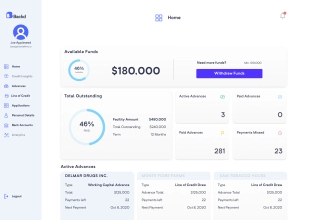

Get instant access to revolving credit with unlimited terms, and the best rates for your business.

Easy payment structures offer amounts with fast turnaround, Simple and easy process to access working capital.

Backd utilizes a soft credit pull so your credit score is never affected when applying for the funding you need. Funds offered start from $10K.

As a business owner, you know your business best. When working with our dedicated team, we'll help create a solution that is best suited to your needs.

We can help tailor your funding to fit your business, adjusting payment options for daily, weekly, or semi-monthly payments.

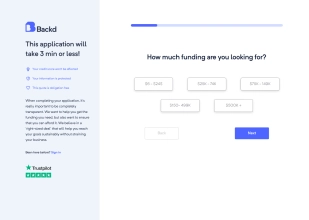

Our application is fast and easy. It takes just a few minutes to get the process started; your pre-approval is just minutes away!

Secure financing for your business by completing our online application.

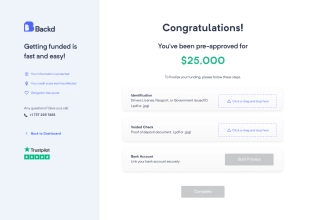

Receive pre-approval immediately once your business financials are submitted electronically.

Once approved, you'll receive the funding in less than 24 hours!

We work hard to empower and support small businesses - the backbone of the economy - that‘s why we believe in reinvesting our success, to help fuel yours.

of financial backing

approved to small businesses

businesses have worked with Backd to obtain the funding they need

What do we require?

We have income opportunities for brokers, affiliate partners, and client-facing institutions to help their clients source the funding they need.

Backd has multiple financial solutions to help businesses and partners grow.